Debit MasterCard®/ATM Card

Choose the card that is right for you.

All of our checking accounts come with your choice of a Bristol County Savings Bank Debit MasterCard® or ATM card. An ATM card can be used at ATMs to withdraw cash, check account balances and transfer funds but cannot be used to make purchases.

Debit MasterCard®

A Debit MasterCard® is a debit card you can use at ATMs to withdraw cash, check account balances and transfer funds. It can also be used to pay for everyday purchases from your checking account. You can use it wherever MasterCard® is accepted.

Other benefits of a Bristol County Savings Bank Debit MasterCard®:- Receive alerts via text message, email or by phone when potential fraudulent activity or unusual transactions occur on your account.

- Set up personalized alerts and controls to monitor your account.

- Shop confidently with Zero Liability coverage for unauthorized purchases1

- Replace your card in the way that is the most convenient for you: request a new card via online or mobile banking or stop by your local branch to have one created for you.

- ATM and Debit card transactions are free at Bristol County Savings Bank ATMs and Allpoint ATMs located within the United States. With over 55,000 ATMs worldwide, finding an Allpoint ATM is easy. Use the Allpoint locator page to find an Allpoint ATM near you.

Mobile Payments and Digital Wallets

Stop carrying a wallet and use contactless payments when you enroll your card in any of the following mobile payment options:

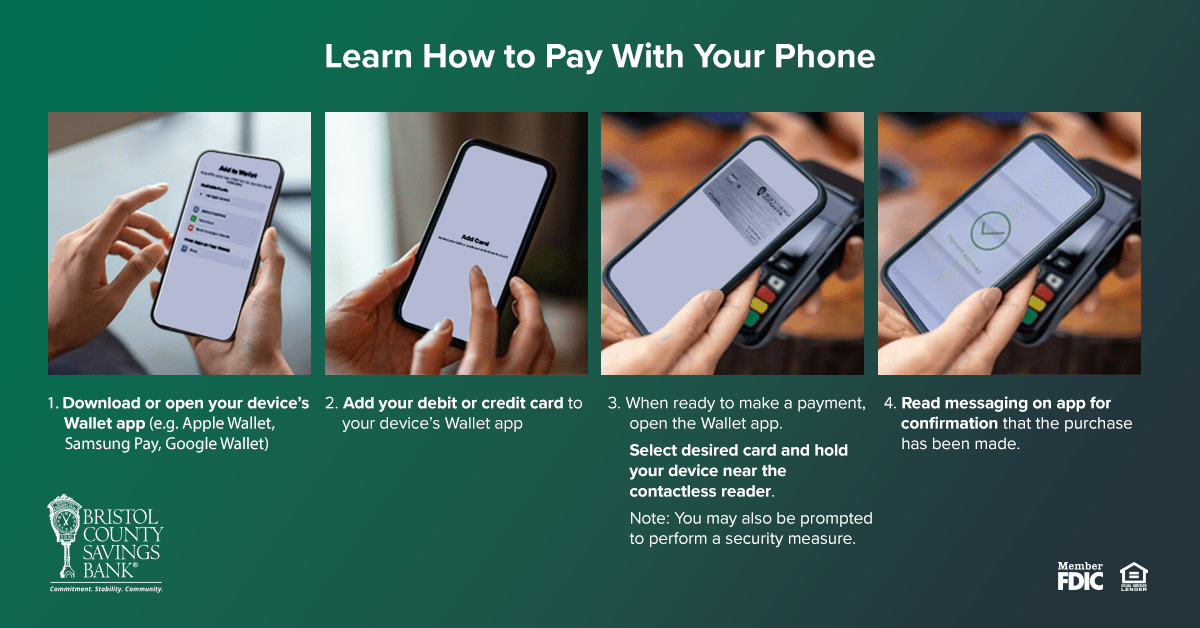

How to Pay With Your Phone

-

Download or open your device's Wallet app (e.g. Apple Wallet, Samsung Pay, Google Wallet)

-

Add your debit or credit card to your device's Wallet app

-

When ready to make a payment open the Wallet app. Select desired card and hold your device near the contactless reader. Note: you may also be prompted to perform a security measure.

-

Read messaging on app for confirmation that the purchase has been made.

Apple Pay

Apple Pay is a safer way to pay that helps you avoid touching buttons or exchanging cash. You can make contactless, secure purchases in stores, in apps, and on the web. Simply add your debit or credit card to the Wallet app by taking its picture and following directions. Once your card is verified, you’re ready to shop. Visit http://apple.com/apple-pay for more information on how to get started using your Debit MasterCard® on your iPhone, iPad, Apple Watch or Mac.

Samsung Pay

Use Samsung Pay to store your credit, debit, and membership cards in your digital wallet. Samsung Pay works in-store, in-app, and online. Extra security and ease of use is in the palm of your hand! Samsung device users can find the Samsung Pay app pre-installed on their device or download it off Google Play. After enabling security with your fingerprint or iris, you’ll be able to enter a pin for future use. After taking a picture of your cards and signing, your cards will be backed up and ready to use. For more information, visit https://www.samsung.com/us/samsung-pay/.

Google Pay

Google Pay is a fast, simple way to pay online, in stores, and more. It brings together everything you need at checkout and keeps your information safe and secure. You can also manage your account on the web or in the app. Visit https://pay.google.com/about/ for more information.

-

- You have used reasonable care in protecting your card from loss or theft; and

- You have promptly reported to your financial institution when you knew that your MasterCard was lost or stolen.

- If you believe there has been unauthorized use on your account and you meet the conditions above, rest easy knowing you’re protected by Zero Liability. Zero Liability does not apply to the following (or certain) MasterCard payment cards: Commercial cards, unregistered prepaid cards or gift cards.